Binge tourism' reaches a new low when police fire rubber bullets to restore peace

For decades now, the Spanish have taken an easy line on foreign tourists and the oceans of alcohol they consume in coastal resorts every summer. Not any more. The party is definitely over in one of the most emblematic of Spain's mass tourism towns, Lloret de Mar on the Costa Brava, where, earlier this month, police fired rubber bullets at gangs of drunken revellers when they ran amok through the city, kicking in shop windows and setting a police car on fire. After two nights of clashes that dragged on until 7am, there were 20 injured, nine of them police officers, and 20 arrests. Tellingly – in a city of 40,000 with 25 discos, 261 bars and roughly a million tourists a year – all those in custody were foreigners, most of them reportedly French.

As far back as 2004 – when, after similar incidents, the then Catalan Minister of the Interior invented the phrase "binge tourism" – there were promises of clean-ups. This time, though, in a year which had already seen 15-year-old British expat Andrew Milroy stabbed to death outside a nightclub, (over which two French men have been arrested), the authorities say they mean business. "We've touched bottom on these questions," the mayor of Lloret de Mar, Roma Codina said. "We will be shutting down the most conflictive bars and banning prostitution in public." For good measure, he added, disco closing times were to be tightened up and there would be a crackdown on underage drinking. The police presence was massively stepped up, too.

But no sooner had things quietened down in Lloret de Mar than trouble popped up elsewhere. Authorities in the Balearic Islands warned last week of a fresh wave of deaths from "balconing", a dangerous game in which inebriated tourists leap from their hotel rooms into the swimming pool below. This year, there have been three deaths – two Britons and one Italian, all in their twenties – and more than a dozen injuries from hotel falls in Ibiza and Majorca, well above the seasonal average. Majorcan hotel owners say they are raising the height of balcony railings and building screens between them; there have also been calls for educational campaigns in the tourists' home countries. It has come to this: leaflets explaining the perils of hurling yourself head first off buildings.

And in Magaluf, until last week you didn't even have to drink to get drunk. On Thursday six "oxy-shot" machines – which convert alcohol into gas, enabling your body to absorb it 10 to 15 times quicker than in liquid form – were confiscated by police from bars and discos in the town. This latest craze to hit Majorca has now been banned in the Balearics. Jose Cabrera, a toxicologist, explained on Spanish radio station Cadena Ser, "Oxy-shots can destroy your lungs, because there is no way of eliminating toxins, which is what happens when alcohol goes through the liver."

Not everyone behaves badly, of course. "The vast majority of tourists are just out for a good holiday, and a good time," says a Spanish man who would only give his name as MLC. He has been delivering beer to El Arenal and Magaluf, Majorca's two key German and British "ghettos" – as the Spanish call them – for 12 years. "But I've noticed that the hardcore drinkers are younger – maybe 15 or 16 – drinking more, and more violent than they used to be. There's no way I'd go into those ghettos alone. It's too scary. But only the British one, eh? The Germans are all right: they just drink, sit down and sing their heads off."

Certainly, at 1am on a Saturday night in Benidorm this month, in the plaza dubbed "British square" on local nightclub flyers, the atmosphere is anything but settled. The first thing you notice is you can't hear a word of Spanish, let alone see it among the swathes of adverts and signs in English for pints, pies, Yorkshire puds, football, fishfingers and beans.

Instead, long lines of stag-nighters lurch and weave their way past huge knots of drinkers outside a row of open-air pubs, all dubbed with British-sounding names such as Piccadilly, Carnaby Street, The Red Lion and Wookey Hole. In fact, the area seems built on fake nostalgia for a slightly rancid vision of England on holiday three or four decades ago. The tribute bands for 1970s and 1980s acts such as Neil Diamond, Shakin' Stevens and Showaddywaddy help, of course, but so do the profusion of comedy clubs for vaudeville turns such as Albi Senior, The British Bulldog of Comedy, or the slightly saucy Roy "Chubby" Brown tribute: "blue, offensive and vulger" [sic]. You have been warned.

There is drinking – lots of it – but nobody's being sick yet, and I don't see any fights, and there are even a few families, their six- or seven-year-olds wandering around. In fact, if you took away the stream of adverts for prostitutes – verbal and otherwise – and the 30C-plus temperature, but retained the truculent, threatening atmosphere outside some of the noisier pub doors, this part of Benidorm would seem like a slightly dingy British inner city, right down to the peeling skyscrapers, trails of dog excrement, and potential for violence.

When trouble does flare up, British residents insist it tends to be limited to one particular zone. "This end of town, I've never seen anything in the five years I've been working here," says Tracy, waitress at one of Benidorm's oldest British pubs, the Duke of Wellington. "It's all around 'British square', that's where you get the lads all falling around and being sick." But given that tourism is one of the few boom industries in an economy in tatters – even if visitors' spending has dropped – you can't help thinking there's only so much tinkering with places like British square that the authorities will be willing to do.

Take Salou. Two years ago, the Costa Dorada resort became Spain's first place to oblige tourists to keep their T-shirts on away from the beaches – or face a €300 (£265) fine. But this town still plays host to the notorious SalouFest, where, for five days, up to 5,000 British students drink each other under the table for as little as £189 all- in. During that annual binge, getting the students to keep their Union Jack shorts and hotpants on in public would be a major achievement, let alone their top halves.

Nor is the tourism industry in great shape. The Benidorm coast's biggest English-speaking newspaper, Costa Blanca News, pointed out last week that although tourist numbers are up, Benidorm hotels are worried because spending is down by as much as 40 per cent. "These last two years have slowed down a lot," Tracy confirms, "we get more Spanish in, and they only have maybe a couple of halves of lager over an hour and a half. They don't spend as much as the British."

Such is the demand among northern Europeans for cheap booze-fuelled holidays, though – as little as €200 all-in for a week – that the region of Alicante has lost half a dozen of its most emblematic five-star hotels in the last three years. Others have downgraded to three or four stars. "There are Happy Hours that go on for the whole of the morning now," MLC confirms. "From 10 or 11am right the way through to 1 or 2pm."

In Barcelona, the third most popular European destination for British stag parties, they banned Happy Hours two years a go. But in Benidorm and other resorts such as Lloret de Mar, the price war has reached ridiculous extremes. In Bendiorm last week you could buy two vodka cubatas – Spanish long drinks usually containing three or four British measures – for €4, or a pint of bitter for €1 "until the first goal scored in the League game".

But as the Spanish are discovering, such offers are a two-edged weapon. Cheaper booze means more business, but it also means more reckless aggression and senseless bravado, as the rubber bullets of Lloret de Mar and the broken bodies of the "balconers" have shown this summer. And until that particular alcohol-powered conundrum is resolved, they are trends that may prove very hard to stop

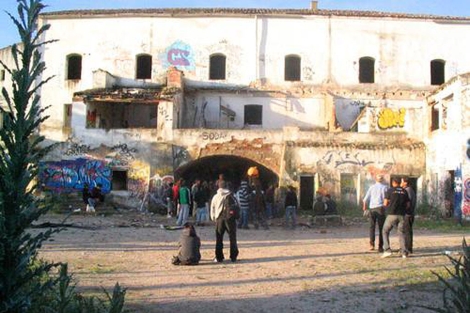

20 year old who was admitted to hospital after attending a rave party in Getafe at the weekend, after which two others died after taking a cocktail of drugs, was discharged from hospital on Tuesday.

20 year old who was admitted to hospital after attending a rave party in Getafe at the weekend, after which two others died after taking a cocktail of drugs, was discharged from hospital on Tuesday.

With an economy in turmoil and a reputation tarnished by tales of dodgy developers and legal nightmares for expats trying to buy their dream home, the Spanish property market has been something of a disaster zone for the past couple of years.

With an economy in turmoil and a reputation tarnished by tales of dodgy developers and legal nightmares for expats trying to buy their dream home, the Spanish property market has been something of a disaster zone for the past couple of years.

0 comments:

Post a Comment